Nourishing Productivity: How to Introduce Meal Allowance for Employees

Discover the key steps to introduce meal allowance for employees and nourish workplace productivity. Enhance employee satisfaction and well-being with meal allowances.

On this page

- What is meal allowance for employees?

- Importance of providing meal allowances for employees

- How does meal cards work in terms of meal allowance?

- Types of meal allowances for employees

- Legal considerations and regulations for meal allowance programs for employees

- Designing an effective meal allowance policy

- How should companies maximize the value of meal allowances?

- Empuls: A convenient solution for pricing meal allowances for employees

- 4 Companies with successful meal allowance programs

- Conclusion

- FAQs

In today's fast-paced work environment, organizations strive to create an atmosphere where employees feel valued and supported. One way to achieve this is by offering meal allowance for employees.

Meal allowances are financial benefits employers provide to cover the cost of meals consumed during work-related activities. They can be in the form of fixed allowances, actual expense reimbursements, or per diem allowances.

The purpose of providing meal allowances is to ensure that employees have access to nutritious meals while engaged in business activities, whether traveling for work, attending conferences or meetings, or working overtime. Employers address their workforce's basic needs by offering meal allowances and promoting employee well-being and satisfaction.

What is meal allowance for employees?

A meal allowance for employees refers to a specific amount of money allocated by an employer to cover the cost of meals during working hours. It is a benefit provided to employees to ensure they have access to meals at the workplace.

The meal allowance can be a cash stipend, reimbursement for meal expenses, or a prepaid meal cards that employees can use at affiliated restaurants or on-site cafeterias.

Meal cards, also known as food or lunch cards, are prepaid cards or vouchers issued to employees by their employers to cover the cost of meals. These cards function as digital payment, allowing employees to conveniently purchase meals at affiliated restaurants, cafes, or canteens.

A meal allowance supports employees' nutritional needs, enhances their well-being, and promotes a positive work environment. It may also serve as a means to comply with legal requirements or collective bargaining agreements regarding employee meal provisions.

Importance of providing meal allowances for employees

Providing meal allowances demonstrates an employer's commitment to the well-being and satisfaction of their workforce. With the help of a meal allowance in the form of meal cards, employers ensure that employees have access to nutritious and affordable meals during their working hours. This contributes to their physical well-being and enhances their overall job satisfaction and productivity.

Moreover, meal allowances can be a valuable perk for attracting and retaining top talent. In a competitive job market, companies that offer comprehensive benefits packages, including meal allowances, are more likely to stand out and attract skilled professionals. It shows that the employer values the needs and comfort of their employees, leading to higher employee engagement and loyalty.

Here are other reasons for implementing meal allowances in organizations:

- Employee well-being: Providing meal allowances demonstrates a commitment to supporting employees' nutritional needs, promoting good health, and ensuring they have the energy to perform their tasks effectively.

- Convenience: Meal allowances simplify the process for employees to manage their meal expenses, eliminating the need to spend their funds and submit individual expense reports.

- Cost control: Setting a fixed meal allowance amount or using per diem rates can help employers establish predictable costs for meal reimbursement, making budgeting and financial planning more manageable.

- Compliance: In some cases, providing meal allowances may be a legal requirement or a collective bargaining agreement provision, ensuring employers fulfill their obligations.

How does meal cards work in terms of meal allowance?

Meal cards operate on a digital payment system. Upon receiving the meal card, employees can load it with a predetermined amount of money, which can vary based on company policies or employee positions. The cards are usually reloadable, allowing employees to add funds as needed.

Employees who wish to purchase a meal can present their meal cards at affiliated restaurants or food service providers. The card is swiped or scanned, and the corresponding amount is deducted from the card balance. Some meal cards may also have a PIN for added security during transactions.

Types of meal allowances for employees

Here are the three types of meal allowances for employees:

1. Fixed meal allowance

A fixed meal allowance is a predetermined amount of money provided to employees for meals during work-related activities. This type of allowance offers a consistent and predictable reimbursement amount, regardless of the actual expenses incurred by the employee.

Employers typically set the fixed allowance based on factors such as the average cost of meals in the area where the employee is conducting business or the specific requirements of the job role. While a fixed meal allowance simplifies the reimbursement process for employees, employers must ensure that the allowance amount aligns with the reasonable cost of meals in the given context.

2. Actual expense reimbursement

Actual expense reimbursement involves employees submitting receipts or expense reports to be reimbursed for the exact amount they spent on meals. This method requires employees to keep track of their meal expenses and provide supporting documentation to the employer.

With actual expense reimbursement, employees are reimbursed based on the actual costs they incur, ensuring that they are not over or under-compensated. However, this approach can be administratively burdensome for employees and employers, as it involves meticulous record-keeping, timely processing, and verification of expenses.

3. Per diem allowance

Per diem allowances provide a flat rate to cover meals and incidental expenses during work-related activities. The employer determines the per diem rate, which is usually based on factors such as the location and duration of the business activity.

Per diem, allowances simplify reimbursement by eliminating employees needing to submit receipts or expense reports. Instead, employees receive a predetermined daily amount intended to cover meals and other incidental expenses, such as tips or small purchases. Employers often reference the per diem rates established by tax authorities or industry standards to ensure fairness and compliance.

Employers must carefully evaluate these factors and consider the needs and preferences of their employees when designing their meal allowance policy

Legal considerations and regulations for meal allowance programs for employees

Here are the legal considerations and regulations for introducing meal allowance programs for employees.

1. Overview of legal requirements regarding meal allowances

To ensure compliance, employers must familiarize themselves with the applicable laws and regulations related to meal allowances. The specific legal requirements may vary depending on the jurisdiction, industry, and employment agreements. It's essential to consult with legal professionals or labor experts to understand the specific obligations and restrictions that apply in your organization's context.

Some common legal considerations include:

- Tax regulations: Tax authorities often have specific rules regarding the tax treatment of meal allowances. Employers and employees must know tax implications, such as whether the allowances are subject to income tax, payroll tax, or social security contributions.

- Labor laws and employment agreements: Collective bargaining agreements or employment contracts may contain provisions related to meal allowances. Employers must ensure compliance with these agreements and any minimum requirements set forth by labor laws, such as providing meal breaks or minimum reimbursement amounts.

- Expense documentation: Depending on the jurisdiction and the chosen reimbursement method, employers may require employees to provide supporting documentation, such as receipts or expense reports, to substantiate their meal expenses.

2. Discussion of tax implications for both employers and employees

- Employer tax implications: Meal allowances provided to employees may have tax consequences for the employer, including potential tax deductions or exemptions. Employers should consult with tax professionals or accountants to understand the specific tax treatment of meal allowances in their jurisdiction.

- Employee tax implications: Employees may be required to include meal allowances as taxable income, depending on the applicable tax laws. However, certain types of allowances or reimbursement methods may be exceptions or exclusions. Employees should consult with tax advisors or refer to tax guidelines to determine their tax obligations.

3. Compliance with labor laws and employment regulations

Employers must ensure that their meal allowance policies align with labor laws and regulations to avoid potential legal issues. This includes complying with requirements related to meal breaks, maximum working hours, and minimum reimbursement amounts. It's essential to stay updated on changes in labor laws and periodically review and revise the meal allowance policy to ensure ongoing compliance.

Designing an effective meal allowance policy

Here are some important factors to consider when designing an effective meal allowance policy:

1. Factors to consider when determining the amount of the allowance

- Cost of living: Consider the average cost of meals in the areas where employees conduct work-related activities. Consider regional price differences and adjust the allowance amount accordingly to ensure it covers reasonable meal expenses.

- Industry standards: Research industry-specific benchmarks or guidelines for meal allowances to gain insights into standard practices and ensure competitiveness within the market.

- Job roles and responsibilities: Different job roles may have varying meal requirements based on travel frequency, client entertainment, or working outside regular office hours. Tailor the allowance amount to align with the specific demands of each role.

- Duration of work-related activities: Consider whether employees will be engaged in short-term assignments or extended business trips. Adjust the allowance amount to accommodate varying meal needs based on the duration of the activity.

2. Setting eligibility criteria for employees

- Travel and business-related activities: Determine which employees will be eligible for meal allowances based on their involvement in work-related travel, client meetings, or other business activities that require meals.

- Job positions or levels: Consider whether meal allowances will apply to specific positions or be available to all employees across the organization. This may depend on seniority, job responsibilities, or the need to align with collective bargaining agreements.

- Temporary or permanent assignments: Define whether meal allowances will be provided for quick jobs or apply to employees permanently. Communicate the criteria for eligibility to ensure consistency and fairness.

3. Defining the scope and limitations of the allowance

- Meal types and occasions: Specify the meals that are eligible for reimbursement. This can include breakfast, lunch, dinner, or snacks during work-related activities. Determine if the allowance covers meals with clients, team meals, or meals during travel time.

- Exclusions and restrictions: Communicate any limitations on meal expenses that the allowance will not cover, such as alcoholic beverages or extravagant dining options. Define reasonable spending limits to ensure responsible use of the allowance.

- Reimbursement frequency: Determine how often employees can claim meal allowances, such as daily, weekly, or monthly, depending on the nature of their work-related activities. Establish clear guidelines and deadlines for submitting reimbursement requests.

4. Developing a fair and transparent reimbursement process

- Documentation requirements: Specify the documentation employees must provide to substantiate their meal expenses, such as receipts or expense reports. Communicate the process for submitting and verifying expenses.

- Timelines for reimbursement: Define the timeframe within which refunds will be processed. Set reasonable turnaround times to ensure employees are reimbursed for their meal expenses promptly.

- Communication and training: Effectively communicate the meal allowance policy to employees, ensuring they understand the eligibility criteria, reimbursement process, and limitations. Provide training or resources to guide employees on accurately documenting and submitting meal expenses.

How should companies maximize the value of meal allowances?

Companies can maximize the value of meal allowances by implementing the following strategies:

1. Encourage healthy eating choices

- Provide nutritional education and resources to help employees make informed food choices.

- Offer healthy and diverse meal options in the cafeteria or provide access to healthy meal delivery services.

- Organize workshops or seminars on nutrition and wellness to promote healthy eating habits among employees.

2. Personalize meal allowances

- Understand employees' dietary preferences and restrictions to ensure their meal allowances cater to their individual needs.

- Offer flexibility in utilizing the meal allowance, such as allowing employees to choose their preferred vendors or meal delivery services.

- Provide options for employees with special dietary requirements, such as vegetarian, vegan, or gluten-free meals.

3. Seek employee feedback and suggestions

- Regularly solicit feedback from employees regarding their meal allowance program.

- Conduct surveys or focus groups to gather insights on the effectiveness and satisfaction levels of the program.

- Use employee input to make necessary adjustments and improvements to the program, ensuring it aligns with their needs and preferences.

4. Foster a positive dining experience

- Create inviting and comfortable dining spaces within the workplace, encouraging employees to enjoy their meals together and build relationships.

- Consider incorporating themed dining events or occasional special treats to make the dining experience enjoyable and memorable.

5. Ensure seamless administration

- Simplify the process of accessing and managing meal allowances, utilizing digital platforms or applications for tracking and reimbursement.

- Streamline administrative procedures, minimizing paperwork and reducing the burden on employees when submitting claims.

Empuls: A convenient solution for pricing meal allowances for employees

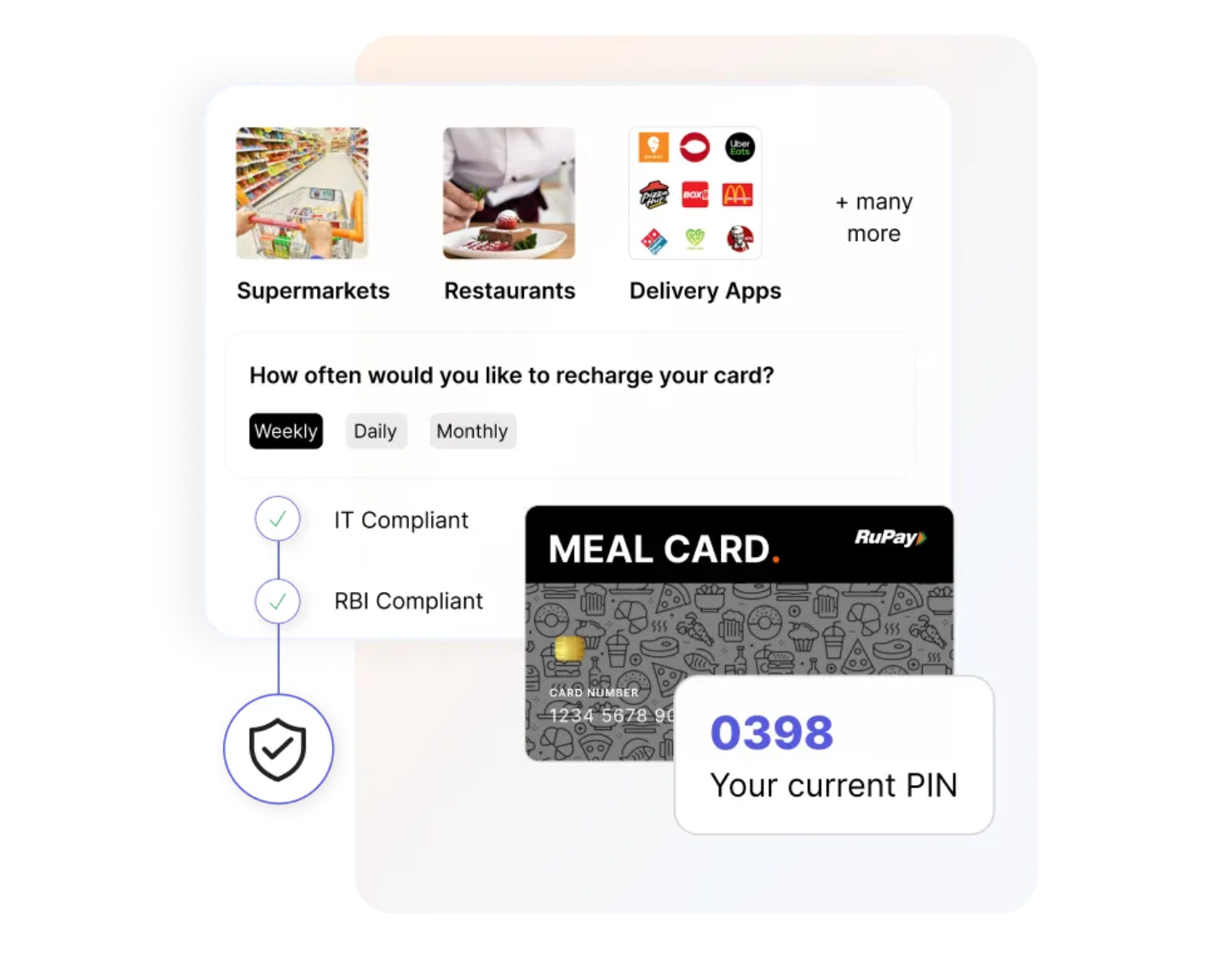

Switch to meal cards from Empuls to offer a flexible way for employees to utilize their meal allowance. The meal card offers freedom of choice as it can be used at online and offline stores.

- Tax savings: Provide tax benefits to employees and employers

- Validity: Valid for a year and can be renewed annually

- Convenience: Easy for HR to manage the food allowance

- Flexibility: Flexibility to purchase various types of food

- Compliance: 100% compliant with IT and RBI regulations

- Reloadable: Reload frequency as per company policy

- Security: Issued with a unique PIN making them secure

4 Companies with successful meal allowance programs

Here are two examples of companies with successful meal allowance programs:

1. Google

Google is known for its employee-centric policies and benefits, including a highly successful meal allowance program. The company offers its employees free meals and snacks at on-site cafeterias and micro-kitchens. These facilities provide various food options, including healthy and diverse menu choices, catering to different dietary preferences and requirements.

Google's meal allowance program ensures that employees have access to nutritious and convenient meals and fosters a sense of community by encouraging employees to dine together and collaborate in a relaxed environment.

2. Salesforce

Salesforce, a global cloud computing company, has a well-regarded meal allowance program called "The Ohana Café." The company provides its employees with a generous daily meal allowance at the on-site café. The Ohana Café offers a variety of healthy and locally sourced food options, accommodating different dietary needs and promoting wellness.

The program also includes a "Food for Thought" initiative, where employees can participate in cooking classes and workshops on nutrition and culinary skills. Salesforce's meal allowance program not only supports employee well-being but also promotes a sense of camaraderie and work-life balance.

3. Airbnb

Airbnb, the popular online marketplace for lodging and experiences, has implemented a successful meal allowance program called "Lunchtime Well-being." The company provides its employees with a daily lunch allowance to be used at nearby restaurants or through meal delivery services.

This program encourages employees to take a break from work, explore local cuisine, and interact socially during lunchtime. By offering various dining options, Airbnb's meal allowance program supports employee well-being and convenience and promotes a healthier work-life balance.

4. Asana

Asana, a leading work management platform, has a well-regarded meal allowance program called "Asana Eats." The company provides its employees with a monthly stipend specifically designated for meals. This allowance can be used at partner restaurants, cafes, and food delivery services.

Asana's program encourages employees to explore local eateries, try new cuisines, and support small businesses in their communities. The meal allowance program not only promotes employee satisfaction and convenience but also contributes to fostering a vibrant and inclusive company culture.

Conclusion

Meal allowances for employees are a valuable benefit that can enhance employee satisfaction, productivity, and work-life balance. By carefully designing and implementing a meal allowance policy, organizations can demonstrate their commitment to employee well-being and create a supportive work environment.

FAQs

1. How much is the meal allowance?

The meal allowance, often referred to as the per diem rate for meals and incidental expenses (M&IE), varies depending on the location of travel. These rates are established annually by the U.S. General Services Administration (GSA) for locations within the continental United States. For specific rates applicable to your travel destination, you can refer to the GSA's per diem rates.

2. What is the standard meal allowance method?

The standard meal allowance method allows taxpayers to deduct a set per diem rate for meals and incidental expenses instead of tracking and deducting actual costs. This simplifies record-keeping, as you only need to document the time, place, and business purpose of your travel without retaining individual meal receipts.

3. Who gets a 100% meal deduction?

Under typical circumstances, most business meal expenses are subject to a 50% deduction. However, certain situations qualify for a 100% deduction, including:

- Meals provided for the convenience of the employer: For example, meals provided on the employer's premises to more than half of the employees to keep them working late or on weekends.

- Company-wide events: Such as holiday parties or annual picnics primarily for the benefit of employees who are not highly compensated.

4. What is the maximum tax-free meal allowance?

The maximum tax-free meal allowance corresponds to the federal per diem rate for meals and incidental expenses for a given location. Employers can reimburse employees up to this rate without the amount being considered taxable income. Reimbursements exceeding the federal per diem rate may be subject to taxation.